Small Business Invoicing Software with Demo Automation for Efficiency

Small Business Invoicing Software with Demo Automation for Efficiency

If you run a small business, freelancing gig, or early-stage startup, invoicing can feel like a slow leak in your day. You do the work, then you spend hours patching together numbers, chasing payments, and fixing mistakes. I've been there. In my experience the right invoicing automation and a clear demo can cut that time in half and keep cash flowing.

This post is for business owners, freelancers, ops folks, and anyone who wants fewer billing headaches. I’ll walk through what to look for in billing software for small business, why demo automation matters, how to avoid common mistakes, and practical steps to implement automated invoicing solutions. Expect plain language, real examples, and small action items you can try this week.

Why invoicing matters more than you think

Invoicing is not just a finance task. It affects cash flow, client relationships, forecasting, and even your reputation. A late or confusing invoice can delay payment and create friction. A clean, timely invoice builds trust and speeds up payment.

For small teams, every hour spent on invoicing is an hour not spent growing the business. I've seen a solo consultant reclaim ten hours a month after switching to automated invoicing. Ten hours that went straight to billable work or sales follow ups.

So when people ask whether they should invest in billing software for small business, the real question is, can you afford not to?

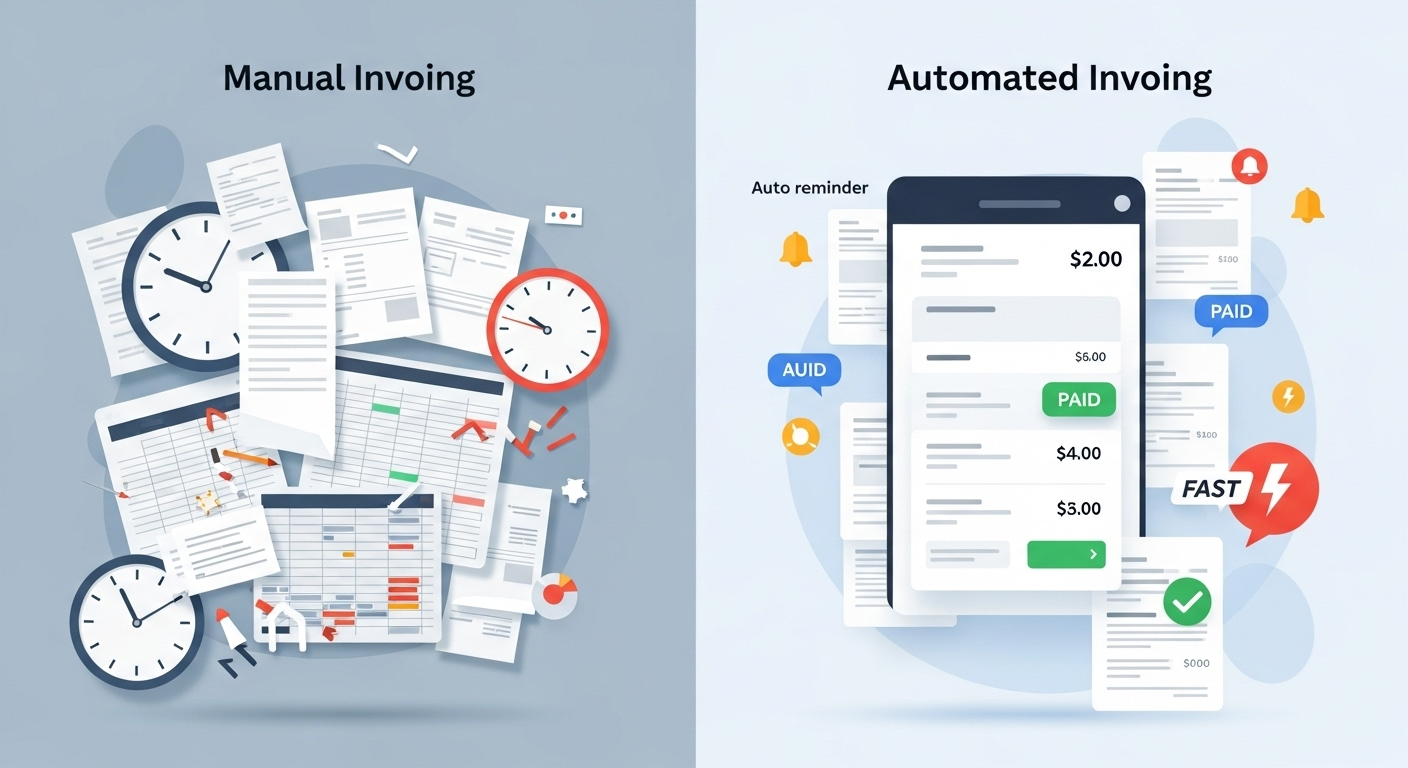

Common invoicing pain points

- Manual data entry and typos. You or your assistant type the same client address or line items over and over. Mistakes sneak in.

- Unclear invoice formats. Clients get confused and delay payment while asking for clarifications.

- Recurring billing that is not automated. You forget subscriptions, or you spend time resending the same invoice each month.

- Poor tracking. You don’t have an easy way to see aging invoices or follow-ups that are due.

- Onboarding new team members. Teaching someone the invoicing process becomes a recurring training cost.

Those are the usual suspects. The fix is not more spreadsheets. It is automation, consistent templates, and a little design sense so invoices read like friendly, clear bills rather than legal notices.

What is invoicing automation and how it helps

Invoicing automation means the software takes repetitive steps off your plate. That includes generating invoices, sending them on schedule, tracking payments, and nudging clients when invoices are overdue. It can also include integrating with project management tools to pull in billable hours automatically.

Think of it like a well trained assistant who never gets tired. The assistant does the routine work, and you do the exceptions. In practice, that reduces errors, speeds up collection, and gives you accurate reports.

Key automation features to look for

- Recurring invoices and subscriptions

- Auto reminders and late fees

- Payment links and multiple payment methods

- Integration with bookkeeping tools like QuickBooks or Xero

- Invoice templates and branding

- Automatic tax calculations

What demo automation is and why it matters

When companies evaluate billing software, they often start with a demo. Demo automation means the demo itself is repeatable, personalized, and driven by data. Instead of a long live walkthrough that requires a sales rep, a demo automation setup can show each prospect the exact features that matter to them, with sample data that feels real.

Demo automation helps in three ways. First, it speeds up buying decisions by letting prospects see value fast. Second, it reduces the sales burden because prospects can self-serve. Third, it improves onboarding because the demo can be replayed during early training sessions.

Here’s a quick example. Imagine a freelance designer evaluating demo invoicing tools. With demo automation, the demo populates invoices using design project line items, shows a recurring retainer setup, and runs a simulated payment. The designer sees how the tool fits immediately, without waiting for a sales call or a canned demo that uses irrelevant examples.

Benefits of combining invoicing automation and demo automation

- Faster adoption. A realistic demo reduces hesitation and gets teams to trial or trial-to-paid conversion faster.

- Lower support costs. Clear demos mean fewer setup questions after purchase.

- Better fit during evaluation. Prospects quickly know if the tool supports their workflows.

- Reduced manual errors. Automations eliminate repetitive mistakes in the invoice cycle.

- Improved cash flow. Faster invoices and payment options shorten days sales outstanding.

In short, demo automation accelerates the path from discovery to value, while invoicing automation delivers ongoing efficiency.

Features to evaluate in billing software for small business

Not every feature is equally important. Here is a prioritized checklist based on what small businesses actually use.

- Invoice creation and templates — Look for customizable templates that reflect your brand. You want something that makes your invoices clear and professional.

- Automated invoicing and recurring billing — This saves time for subscription work or repeat clients.

- Payment options — Support credit cards, ACH, and payment links. The easier you make it to pay, the faster you’ll get paid.

- Invoice tracking software features — Status tracking, aging reports, and a dashboard to see outstanding amounts at a glance.

- Integrations — Sync with accounting software, CRM, and project management tools so data flows without copy paste.

- Auto-reminders and late fees — Built-in follow up saves awkward emails and improves on-time payment.

- Security and compliance — Encryption, PCI compliance for card payments, and reliable backups.

- Demo automation — A demo that shows your setup or provides guided tours speeds decision making.

Common mistakes when choosing invoicing software

I've seen many teams pick tools for the wrong reasons. Here are frequent missteps to avoid.

- Selecting a tool because it has the most features. More features can mean more complexity. Pick the features you'll use regularly.

- Ignoring integrations. If your accounting or CRM doesn't sync, you'll still be doing manual work.

- Underestimating training time. Even simple systems need a short onboarding plan.

- Not testing the demo with real examples. If the demo looks generic, ask for a tailored scenario or use demo automation to insert your data.

- Failing to think about scaling. Choose a tool that grows with your business, rather than one you'll outgrow in a year.

The Polish step: finalize and humanize invoices

Before you send an invoice, take a short polish step. This is where the invoice gets a quick human review so it’s accurate and client friendly.

Actionable polish checklist

- Confirm client name and contact details are current.

- Make sure line items are readable and priced correctly.

- Include a friendly note or project summary, especially for larger invoices.

- Double check tax and discount calculations.

- Ensure payment links work in a test environment.

This takes a few minutes, but it saves you hours on back-and-forth correction later. With automation, you can make the polish step a quick verification rather than a full rebuild.

How demo automation speeds onboarding and reduces churn

Onboarding is where many tools lose their promise. The software looks great in a demo, but new users struggle with setup. Demo automation reduces that gap in two ways.

First, it provides role-specific walkthroughs. If you are a finance lead, the demo will highlight reconciliation and reporting. If you are a freelancer, it will show how to create a quick invoice, add payment links, and set up reminders.

Second, it creates reproducible scenarios. Instead of a one-off sales demo, you get a repeatable guided setup that new hires or contractors can run themselves. That lowers churn because users reach their first "aha" moment sooner.

Real numbers make this concrete. A small firm I know used demo automation and reduced setup calls by 60 percent. Their team started sending invoices the first week instead of spending two weeks learning the system.

Simple workflow examples

Here are three short, real-world workflows you can copy.

1. Freelance designer quick invoicing

- Create a template with your hourly rate and default expenses.

- Enable a payment link in the invoice so clients can pay by card.

- Set an auto reminder at 7 days and 14 days with escalating tone.

- Use demo automation to show how a contract line item becomes an invoice automatically after project completion.

This removes the manual step of rebuilding invoices for every client and ensures you get paid faster.

2. SaaS startup recurring billing and trials

- Set up subscription tiers and trial expiration rules.

- Automate trial-to-paid emails and payment collection when the trial ends.

- Use invoice tracking software to watch churn and upgrade patterns.

- In demos, simulate upgrading a customer mid-cycle so sales understands proration.

Getting recurring billing right early avoids revenue leakage later.

3. Small agency project billing and retainers

- Use time tracking integration to pull billable hours into draft invoices.

- Set retainers as recurring invoices and track balance usage.

- Enable consolidated invoices so clients with multiple projects get one monthly bill.

- Demo automation can generate a sample consolidated invoice for each client type during sales or training.

This keeps accounts tidy and prevents mixed messages with clients about what they owe.

How to evaluate demo invoicing tools

Don’t just watch a slick demo. Test it using these steps. I recommend doing this as a checklist with the vendor.

- Ask for a sandbox account preloaded with sample data that resembles your business.

- Request a guided scenario that shows your typical invoice flow.

- Confirm how the demo handles sensitive data. Is there a safe way to test live payment links?

- Measure the time it takes to create and send an invoice in the demo. Fast equals lower time to value.

- Find out if the demo can be replayed and shared internally for training.

If a vendor cannot provide a realistic demo or demo automation, that is a red flag. Good vendors use demos to reduce friction, not add friction.

Integration and automation best practices

Automation works best when systems talk to each other. Here are practical tips to make integrations smooth.

- Start with your core systems: accounting, CRM, and project management. Make these a priority for integration.

- Use native integrations where possible. Zapier or middleware is useful, but native connections are usually more reliable.

- Map data fields before you sync. Make sure client IDs, taxes, and product codes match across systems.

- Test with a small batch of invoices before rolling out to all customers.

- Set clear ownership within your team for who handles integration issues and monitoring.

Little mismatches in data mapping cause big confusion. Spend a few hours in setup and save weeks of troubleshooting later.

Security and compliance made simple

Security is not optional. Clients expect their billing info to be handled safely. Here is a short checklist to keep things simple and compliant.

- Use a PCI compliant provider for card payments.

- Ensure your vendor encrypts data at rest and in transit.

- Confirm how backups are handled and how long data is retained.

- Ask about role-based access so only finance staff can view sensitive information.

- Document your own internal access and retention policies.

Don't let compliance be an afterthought. In my experience, counting this as a core requirement reduces headaches during audits and client conversations.

Measuring success: metrics that matter

Automation is only as good as the results it produces. Track these metrics to see if your invoicing and demo automation are working.

- Days sales outstanding or DSO. A lower DSO means faster collection.

- Invoice error rate. Fewer edits means cleaner processes.

- Time spent per invoice. Track before and after automation.

- Conversion rate from demo to trial to paid. Demo automation should improve these numbers.

- Support tickets related to billing. Fewer tickets mean clearer invoices and better demos.

Set realistic targets and measure monthly. Small improvements compound over time.

Cost and ROI: a simple calculation

People worry about the price of invoicing software. Here is a lean way to calculate ROI so you make a data-driven choice.

Estimate your current monthly invoicing cost

- Hours spent per month on invoicing: multiply by hourly rate.

- Late payment costs: estimate interest or lost opportunities.

- Support and error correction time.

Estimate gains from automation

- Hours saved per month by automation.

- Reduction in DSO as a percentage of monthly revenue.

- Fewer support tickets and errors.

Then compare savings to subscription cost. For many small businesses, saving even a few hours a month and getting paid a few days faster covers the subscription easily. I’ve seen teams get a full payback within the first two months.

Real-world pitfalls and how to avoid them

Automation reduces errors but introduces other risks if not managed carefully. Here are pitfalls I’ve seen and simple fixes.

- Over-automation that hides errors. Fix: Keep a review step for high-value invoices.

- Assuming all clients accept electronic payments. Fix: Offer multiple payment options and confirm preferences during onboarding.

- Relying on templates that don’t fit local tax rules. Fix: Test templates with real scenarios and consult a tax advisor if needed.

- Not backing up configuration settings. Fix: Export templates and automation rules periodically.

- Forgetting to train staff. Fix: Use demo automation recordings as training materials and schedule a short workshop.

Choosing the best invoicing software 2025

There are many good options. When you evaluate for 2025, prioritize tools that are built to work with modern stacks and that support demo automation out of the box. You want software that makes billing invisible to your day-to-day work, not a new thing to manage.

Questions to ask vendors

- How does your demo automation personalize scenarios for different business types?

- Can I import my customer list and product catalog easily?

- What integrations do you support natively?

- How do you handle refunds, credits, and proration?

- What security certifications do you hold?

- Do you offer sandbox accounts for testing live flows?

When a vendor answers these crisply and can show automated demos that match your use cases, you are in a good spot.

Implementation plan you can follow this month

If you want to get started quickly, here is a one month plan that I recommend. It is practical and keeps risk low.

- Week 1: Define requirements. List must-have features and integrations. Gather three real invoices as samples.

- Week 2: Run demos with 2-3 vendors. Use their demo automation or request a tailored sandbox. Time how long it takes to create a real invoice.

- Week 3: Pick a vendor and run a pilot with a subset of customers or internal invoices. Test payment links and reminders.

- Week 4: Roll out to all customers, set up a quick training session, and monitor metrics like DSO and invoice errors.

Small tweaks during the pilot save huge headaches after rollout. Keep the team informed and document any custom rules you create.

Integrating invoicing into your customer lifecycle

Invoicing should fit naturally into how you onboard and service clients. Here are a few integration points I’ve found useful.

- Onboarding checklist includes preferred billing method and contact person for invoices.

- Contracts are linked to invoice templates so you never bill the wrong rate.

- Account managers get automated alerts for unpaid invoices tied to their accounts.

- Renewal workflows trigger invoice creation and notify sales about upsell opportunities.

Think about invoicing early in the customer lifecycle and you avoid awkward corrections later.

Final checklist before you commit

Here is a compact checklist to run through before you sign a contract with a vendor.

- Sandbox demo with your data or close proxies.

- Clear integration plan with accounting and CRM.

- Security and compliance verified.

- Training materials available or demo recordings for your team.

- Support and SLAs are acceptable.

- Ability to export your data easily if you leave.

Simple, but it covers the big risks.

Why I recommend demo automation as a priority

In practice, demo automation is a multiplier. A great automated invoicing system saves effort every month. A great demo automation practice reduces friction in buying and onboarding. Put them together and the result is more time and faster cash.

From my own experience helping small teams evaluate tools, demos that felt real led to faster internal buy-in and faster implementation. And the teams that measured the impact saw clear improvements in cash flow and reduced time to reconcile month end.

Closing thoughts

Invoicing does not have to be a grind. The right billing software for small business, combined with demo automation, lets you focus on client work instead of chasing payments. Start small, pick features that solve your biggest pain points, and insist on a realistic demo that uses your examples.

If you follow the steps above, you’ll likely save time, reduce errors, and get paid faster. And yes, you will feel a little more in control of your business finances.