What is Pre-Sales? A Complete Guide for Beginners

If you’ve ever wondered “what is pre-sales?” you’re in the right place. Pre-sales is one of those business functions that quietly decides whether deals close or stall. For startups, B2B businesses, and sales teams trying to scale, understanding pre-sales can be the difference between long, painful sales cycles and shorter, more predictable wins.

I’ve worked with founders and pre-sales teams enough to see the same patterns over and over: companies either undervalue pre-sales or treat it like a magic black box. In my experience, getting pre-sales right is mostly about process, clarity, and the right people not just tools or fancy demos.

Quick definition: Pre-sales meaning

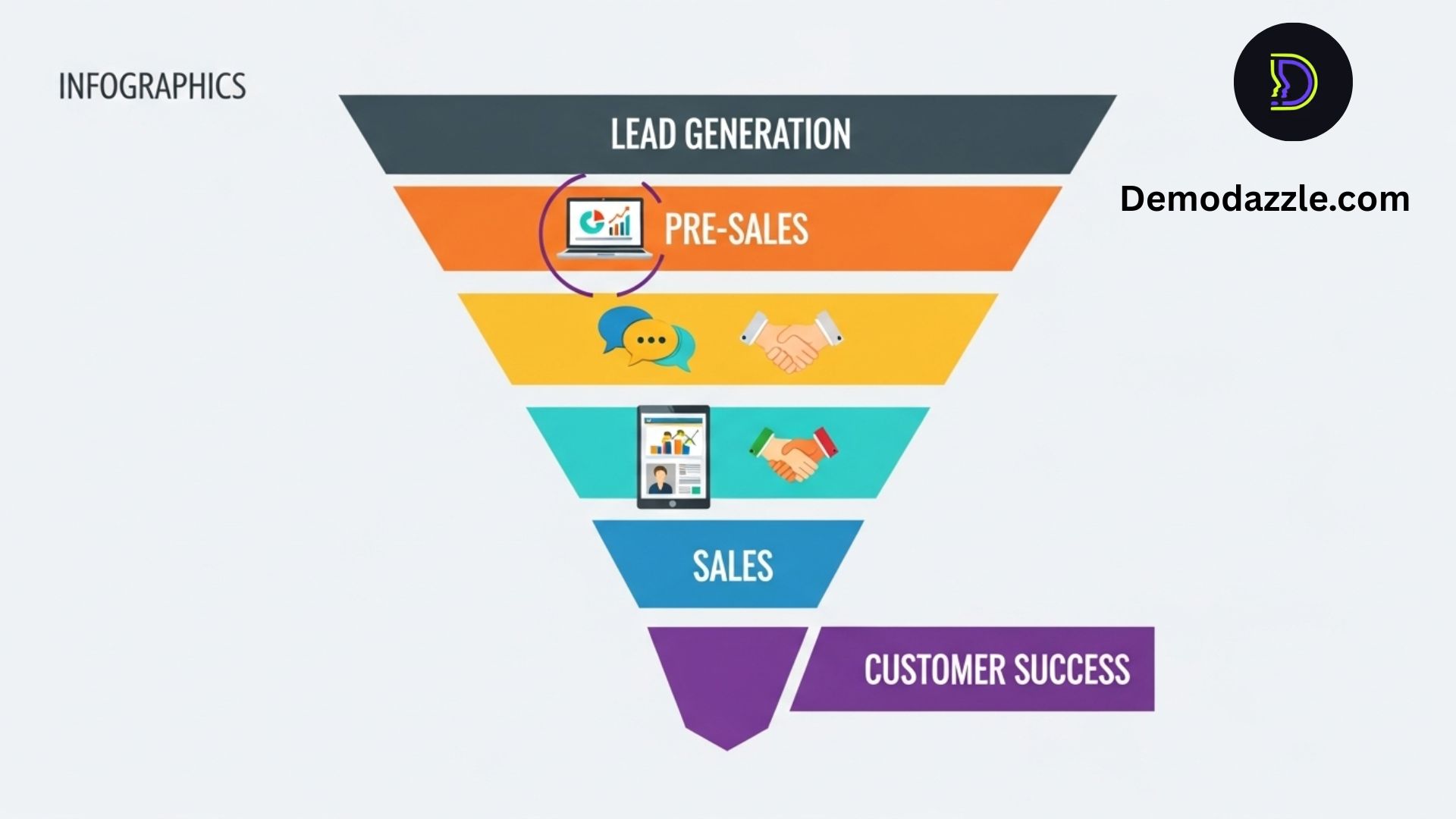

Pre-sales refers to the set of activities, people, and processes that prepare prospects to buy. It sits between marketing (lead generation) and post-sales (implementation and customer success). Think of pre-sales as the bridge that connects a lead’s interest with a salesperson’s ability to close.

That bridge includes technical validation, discovery conversations, custom demos, proofs of concept (PoCs), ROI modeling, and proposal design. Those tasks answer two critical questions prospects always have: “Will this work?” and “Is it worth it?”

Why pre-sales matters quickly

- It shortens the sales funnel by removing technical and commercial uncertainty.

- It improves conversion rates through tailored demos and proposals.

- It protects product integrity by aligning expectations up front.

- It helps product teams learn what buyers actually need.

In plain terms: good pre-sales makes your sales team look smarter, your product look reliable, and your proposals more convincing.

The core pre-sales activities

Let’s break down pre-sales activities into bite-sized pieces. This is where most teams trip up they either skip steps or run them without a clear goal.

- Discovery and qualification: Deep conversations with buyers to understand business goals, constraints, and decision criteria. Not the same as a surface-level lead qualification.

- Technical validation: Ensuring the product can meet the prospect’s technical requirements architecture fit, integrations, security, scalability.

- Custom demos: Tailored demos that show the product solving the buyer’s specific use case rather than a generic product tour.

- Proof of concept (PoC) or pilot: Low-risk ways for prospects to test the product with real data or workflows.

- ROI and business case: Building financial models that quantify value reduced cost, increased revenue, or time saved.

- Proposal and solution design: Putting requirements into a structured, executable plan including timelines, scope, and pricing.

- Stakeholder technical briefings: Presentations for architects, security teams, and execs to clear technical and governance obstacles.

- Demo environments and collateral: Maintaining sandboxes, recordings, templates, and playbooks that scale the pre-sales effort.

These are the building blocks of any good pre-sales program. Miss one or rush them and you’ll feel it later usually as scope creep or churn.

Who does pre-sales? Roles explained

Titles vary across companies, but here are the common pre-sales roles you’ll see in B2B organizations:

- Pre-Sales Consultant / Pre-Sales Specialist: Focuses on discovery, demos, and aligning solutions to business problems. Often the primary customer-facing technical resource.

- Pre-Sales Engineer / Solutions Engineer: Technical expert who handles architecture reviews, integration questions, and PoCs. They translate customer requirements into technical solutions.

- Sales Engineer / Systems Engineer: Often used interchangeably with pre-sales engineer. In larger orgs, they might own a narrower technical domain.

- Solution Architect: Works on complex enterprise deals, designing multi-system solutions and coordinating with product and engineering teams.

- Pre-Sales Analyst: Supports with ROI models, competitive analysis, and technical scoring good for data-driven selling.

One common mistake is trying to make sales reps perform deep pre-sales tasks without training. It rarely works well. Pre-sales roles exist because effective discovery and validation require a mix of product knowledge, technical depth, and consultative selling skills.

Pre-sales vs sales where’s the line?

It’s normal to ask: how is pre-sales different from sales? The short answer: sales closes the deal, pre-sales de-risks it.

Sales reps drive relationships, negotiate commercial terms, and handle contract discussions. Pre-sales professionals dive into technical fit, customize the solution, and produce artifacts (demos, PoCs, and business cases) that make the buyer comfortable signing a contract.

That said, the best outcomes happen when pre-sales and sales are tightly integrated. When they operate as silos, you get mixed messaging, duplicated work, and slower cycles. Collaboration beats separation every time.

Essential pre-sales skills

These are the skills I see matter most in successful pre-sales teams:

- Active listening: Learn to hear problems, not just responses.

- Technical literacy: Not necessarily being an engineer, but being comfortable with integrations, APIs, and architectures.

- Storytelling: Convert technical features into business outcomes and clear narratives for different stakeholders.

- Presentation & demo design: Run memorable demos clear, concise, and focused on value.

- ROI modeling: Create simple but defensible financial models for buyers.

- Project scoping: Define timelines, deliverables, and success criteria for pilots or PoCs.

- Negotiation & influence: You’ll need to steer internal and external stakeholders toward practical decisions.

In my experience, the combination of soft skills and technical comfort wins more deals than raw product knowledge alone.

Pre-sales process a practical playbook

Every company’s process looks slightly different, but here’s a reliable playbook you can adapt. I’ll keep it practical the kind of roadmap I’d hand to a new startup pre-sales hire.

-

Initial qualification:

Start with lead intelligence. Use a discovery call template that focuses on outcomes (what success looks like), constraints (budget, timeline, technical blockers), and decision makers. Avoid running a demo until you understand the buyer’s objectives.

-

Technical discovery:

Bring in a pre-sales specialist or engineer to validate integrations, compliance requirements, and data flow. Document technical requirements and any “red lines” early.

-

Value alignment & custom demo:

Build a short, tailored demo that addresses the buyer’s top 1–2 use cases. Keep it crisp 10–20 minutes for execs, longer for technical teams. Record the demo for internal reuse and training.

-

Proof of concept or pilot (if needed):

Design small, measurable pilots with clear success criteria. Make sure the scope is narrow and time-boxed. Too many pilots become free implementations.

-

Build the business case:

Create an ROI model and a one-page summary of benefits, risks, and costs. Include comparators where possible (status quo vs. with your solution).

-

Proposal and handoff preparation:

Draft a solution design with timelines, responsibilities, and a realistic implementation estimate. Align with delivery teams early.

-

Executive review and sign-off:

Present the solution to decision-makers, address final objections, and document the agreed scope. Get written acceptance of success criteria where possible.

Each stage should have an objective and an exit criterion. That discipline reduces back-and-forth and keeps deals moving forward.

Tools and tech for pre-sales

A few tools dramatically increase pre-sales effectiveness. I’ve seen teams go from reactive to proactive simply by standardizing environments and collateral.

- CRM (Salesforce, HubSpot): Track buy-side requirements, stakeholder maps, and demo history.

- Demo platforms and sandboxes (DemoDazzle, product sandboxes): Host reproducible, customer-specific demos that run consistently and avoid “it works on my laptop” moments.

- CPQ & proposal tools (Apttus, PandaDoc): Generate clean, accurate proposals fast.

- POC automation tools: Scripts and templates to provision test environments quickly.

- Analytics & recording tools: Record demos, analyze engagement, and reuse the best snippets.

- Knowledge bases & playbooks: Centralized content for standard responses, templates, and demo scripts.

Pro tip: invest in a reproducible demo environment early. It saves hours of prep time and avoids embarrassing live-demo bloopers.

Metrics that matter for pre-sales

Measure what actually impacts deals. Vanity metrics feel good but don’t help you predict revenue.

- Qualification rate: Percentage of leads that move from marketing to a qualified sales opportunity after pre-sales engagement.

- Conversion rate: From opportunity to closed-won with pre-sales involvement vs. without.

- Average sales cycle length: How quickly deals close when pre-sales is involved.

- Win rate: Percentage of opportunities won where pre-sales contributed a defined deliverable (demo, PoC, ROI).

- Time to value in pilots: How long pilots take to demonstrate the promised outcomes.

- Customer satisfaction with pre-sales: Simple NPS or satisfaction surveys for stakeholders who interacted with pre-sales.

Track these over time and tie them to revenue. That’s how you justify more pre-sales headcount or tool investments to your leadership team.

Common mistakes and pitfalls

Let’s be blunt. Many teams get pre-sales wrong for predictable reasons. Here are the traps I keep seeing:

- Late involvement: Waiting until late-stage negotiations to bring in pre-sales. When you do this, you’re firefighting, not preventing problems.

- No documented success criteria for pilots: A pilot without clear outcomes turns into an unpaid project for your team.

- Over-customization: Building bespoke features during pre-sales that become permanent commitments without R&D involvement.

- Poorly executed demos: Long, feature-dump demos that don’t speak to buyer outcomes. Short and focused wins every time.

- Weak handoffs: No clear transition between pre-sales and delivery this causes confusion and rework.

- Not measuring impact: If you can’t show how pre-sales improves conversion or shortens cycles, you’ll struggle for budget.

I've noticed that teams that document their pre-sales playbook and enforce minimal demo standards avoid most of these problems.

How to structure pre-sales in your startup

Early-stage startups often ask whether they need dedicated pre-sales people. The honest answer: it depends on your product complexity and customer size.

If you sell a simple SaaS product to SMBs, a well-trained sales rep can handle light pre-sales tasks. But as soon as your product requires integrations, security reviews, or executive-level buy-in, you’ll want a dedicated pre-sales engineer or consultant.

Here are three simple models:

- Embedded model: Pre-sales reps are embedded with GTM teams and support a few reps each. Good for scaling mid-market.

- Centralized model: A shared pre-sales pool handles all technical touches across the company. Works well for cross-product complexity.

- Hybrid model: A central team with embedded specialists for strategic accounts. Best for enterprise-heavy businesses.

When hiring, look for people who can translate technical details into business outcomes. Bonus points for experience with demos, PoCs, and ROI modeling.

Building a pre-sales strategy that scales

Strategy is the part where many companies stop being tactical and start thinking long-term. Here’s a practical framework you can use.

- Define the mission: What problems does pre-sales solve for your company? Faster deals? Fewer escalations? Higher ACV?

- Map the buyer journey: Identify the buyer’s key moments of doubt and create assets or processes to address each one.

- Create a playbook: Standardize discovery questions, demo scripts, PoC templates, and handoff gestures.

- Invest in reusable assets: Always prefer repeatability recorded demos, config templates, and onboarding checklists.

- Measure and iterate: Use the metrics above and run quarterly reviews with sales and product teams.

- Enablement loop: Feed learnings back to product and marketing to reduce future friction.

A focused pre-sales strategy reduces randomness in deals and helps you scale predictable revenue.

Practical tips for demos that win

Demos are the most visible pre-sales activity. Here’s how to make yours better fast.

- Start with the outcome: Open by stating the prospect’s problem and how you’ll show it solved in the demo.

- Keep it short: Exec demos should be 10–15 minutes. Technical deep dives can run longer, but split sessions by audience.

- Use customer data (when possible): Pre-populate demo environments with realistic data it helps prospects visualize the solution.

- Practice transitions: Smooth handoffs between functions (sales → pre-sales → engineering) reduce awkward pauses and duplication.

- Always end with next steps: Confirm acceptance criteria for pilots or PoCs, and the timeline for the proposal.

One aside: never wing a demo. I’ve sat through demos where the rep apologized for being “a bit unprepared.” That’s a deal killer. Practice, rehearse, and use recorded snippets for consistency.

How to run an effective Proof of Concept (PoC)

PoCs can be powerful when designed right. They can also become expensive and time-consuming if scope creeps. Here’s a simple checklist I’ve used repeatedly:

- Define a one-page statement of work: objectives, success metrics, timeline, and responsibilities.

- Limit the scope to the minimum viable test that will prove the buyer’s top risk or hypothesis.

- Assign a PoC owner on both sides clarify communication channels and meeting rhythms.

- Automate provisioning where possible reduce setup time and manual errors.

- Collect success artifacts screenshots, logs, and an executive summary that ties back to the business case.

- Review and convert quickly don’t let the demo momentum fade after the PoC ends.

Common pitfall: treating PoCs as free deployments. Build guardrails and charge for additional scope.

Examples: Pre-sales at work (short case studies)

Two short examples to illustrate how pre-sales impacts outcomes.

Case 1: Mid-market SaaS startup

Problem: Long sales cycles with security-conscious buyers.

Fix: The company hired a pre-sales engineer, built a security checklist, and created an on-demand demo environment with anonymized data. They introduced a 2-week security review PoC and a one-page ROI template for decision-makers.

Result: Sales cycle shortened by 30% for deals requiring security reviews, and win rate improved for those accounts.

Case 2: Enterprise data platform

Problem: Prospects requested bespoke integrations during evaluation, causing scope creep.

Fix: The pre-sales team standardized integration patterns, created a guided self-service sandbox, and introduced a fixed-fee “integration pilot” package.

Result: Reduced custom engineering work in pre-sales, clearer expectations, and faster contract negotiations.

Hiring and onboarding pre-sales talent

When you hire pre-sales people, look for evidence of practical experience rather than just certifications. Ask candidates to:

- Run a 10–15 minute mock demo focused on a customer use case.

- Walk through a past PoC and describe how they measured success.

- Explain a technical problem they solved with non-engineering stakeholders.

Onboarding should include shadowing a few live deals, access to demo environments, and a 30/60/90 day checklist that includes measurable contributions (like owning a PoC or creating a demo template).

Pre-sales enablement what to train on

Enablement should be ongoing. Here’s a prioritized list of what to train pre-sales teams on:

- Product & release notes: so they never get blindsided by changed behavior.

- Demo scripting and recording best practices: clarity beats creativity under time pressure.

- Security & compliance basics: common questions and where to find company policies.

- ROI modeling: how to build simple financial justification models.

- Objection handling: role-play common scenarios like “we already tried something similar.”

Short, repeatable enablement sessions work better than long one-off trainings. Record everything for future hires.

How pre-sales supports product and marketing

Pre-sales doesn’t sit in a vacuum it feeds product and marketing with real buyer intelligence. The best pre-sales teams run a feedback loop:

- Share common feature requests and deal-breakers with product management.

- Provide marketing with one-pagers, competitive battlecards, and real customer stories for campaigns.

- Document failed deals and analyze root causes was it price, product, or timing?

When you treat pre-sales as a listening post, product development becomes less guesswork and marketing becomes more targeted.

Also read:-

- Selling vs Sale: What’s the Difference and Why It Matters

- Best Free Alternatives to Snipping Tool in 2025

- Best AI Logo Generators in 2025: Create Stunning Logos Instantly

- Top Mobile Avatar Maker Apps for iOS & Android in 2025

Pre-sales strategy for founders and early teams

If you’re a founder or building a small GTM team, here’s a simple checklist to get pre-sales right without overinvesting:

- Start with a single pre-sales hire (engineer or consultant) if you’re selling to mid-market or above.

- Create a standard 30-minute discovery template and a 15-minute exec demo template.

- Build one reproducible sandbox demo and document how to reproduce it.

- Measure two KPIs: time-to-close for deals with pre-sales vs. without, and win rate change after introducing pre-sales.

- Iterate monthly — keep changes small and measurable.

In my experience, these simple steps give you big returns without heavy upfront spend.

Final checklist — launch or improve your pre-sales

- Document a pre-sales playbook: discovery script, demo template, PoC template.

- Standardize demo environments and record reusable content.

- Define success criteria for pilots and make them measurable.

- Integrate pre-sales into CRM and sales stages with clear outcomes.

- Run quarterly reviews with sales and product to close the feedback loop.

These actions move pre-sales from ad-hoc to strategic. In practice, the firms that treat pre-sales as a repeatable function are the ones that scale predictable revenue.

Helpful Links & Next Steps

- Book a quick demo: https://bit.ly/meeting-agami

- Try DemoDazzle: www.demodazzle.com

- Learn more on our blog: https://demodazzle.com/blog/

Conclusion

Pre-sales is more than a checklist it’s the practice of removing doubt and building confidence. For founders, sales teams, and pre-sales consultants, mastering the pre-sales role means designing repeatable processes, hiring people who can translate technical detail into business value, and measuring the right outcomes.

Start small, focus on repeatability, and iterate. I’ve seen early investments in pre-sales pay for themselves quickly through shorter sales cycles and higher win rates. If you want help building demo environments, templates, or a pre-sales playbook, DemoDazzle has resources and tools that can help or you can book a free demo to see an example in action.

Frequently asked questions (brief)

Do I need pre-sales for SMBs?

Not always. If your product is simple and adoption is self-serve, invest more in product-led growth and less in pre-sales. However, if buyers need integrations, compliance checks, or custom onboarding, pre-sales becomes necessary.

What’s the difference between pre-sales and customer success?

Pre-sales helps buyers choose and validate a solution. Customer success helps customers get value after they buy. The handoff between them should be seamless and well-documented.

How many pre-sales reps per sales rep is optimal?

There’s no magic number. For mid-market, a 1:3 to 1:6 pre-sales-to-sales ratio is common. For enterprise accounts, you’ll see ratios closer to 1:10 or dedicated pre-sales per strategic rep. Measure workload and adjust.